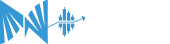

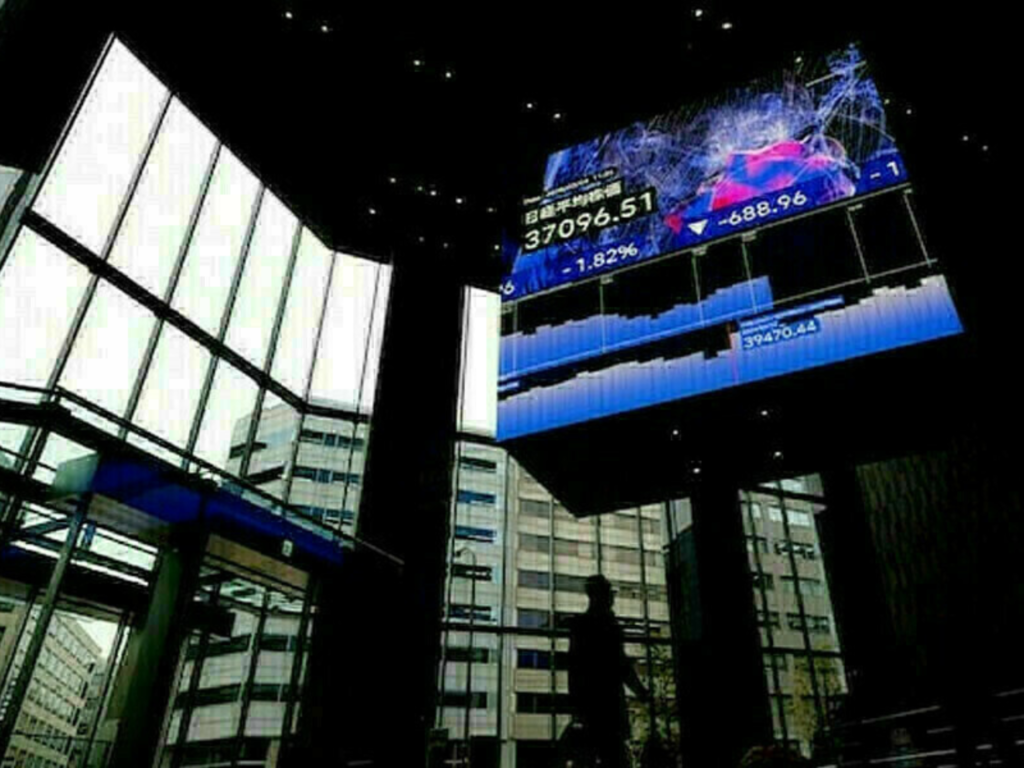

Asia Markets Tumble as Trump’s 50% Tariff Threat Sparks Currency War Fears

Financial markets across Asia-Pacific suffered their worst day in 18 months Thursday after former U.S. President Donald Trump proposed 50% tariffs on all Chinese imports if re-elected, sending shockwaves through currency and equity markets.

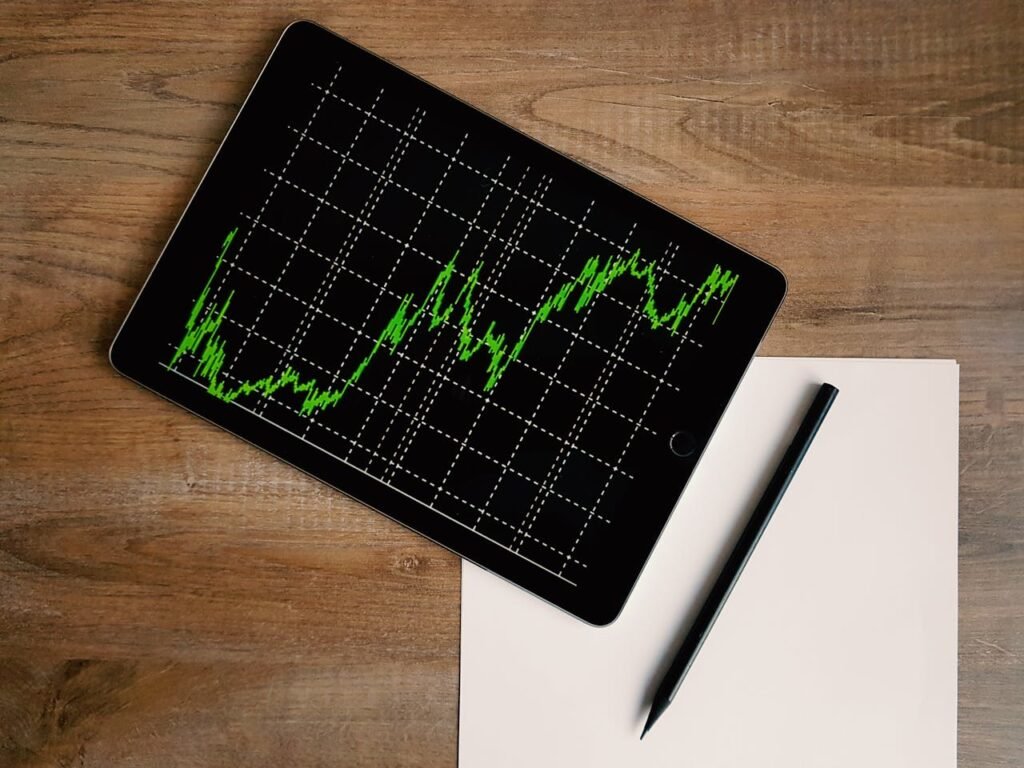

Market Bloodbath:

- Shanghai Composite: -4.1% (biggest drop since Feb 2024)

- Hang Seng: -5.3% (Alibaba -7.2%, Tencent -6.8%)

- Nikkei 225: -3.2% (Toyota -4.5% on China exposure)

- ASX 200: -2.7% (Miners BHP -5.1%, Rio Tinto -4.9%)

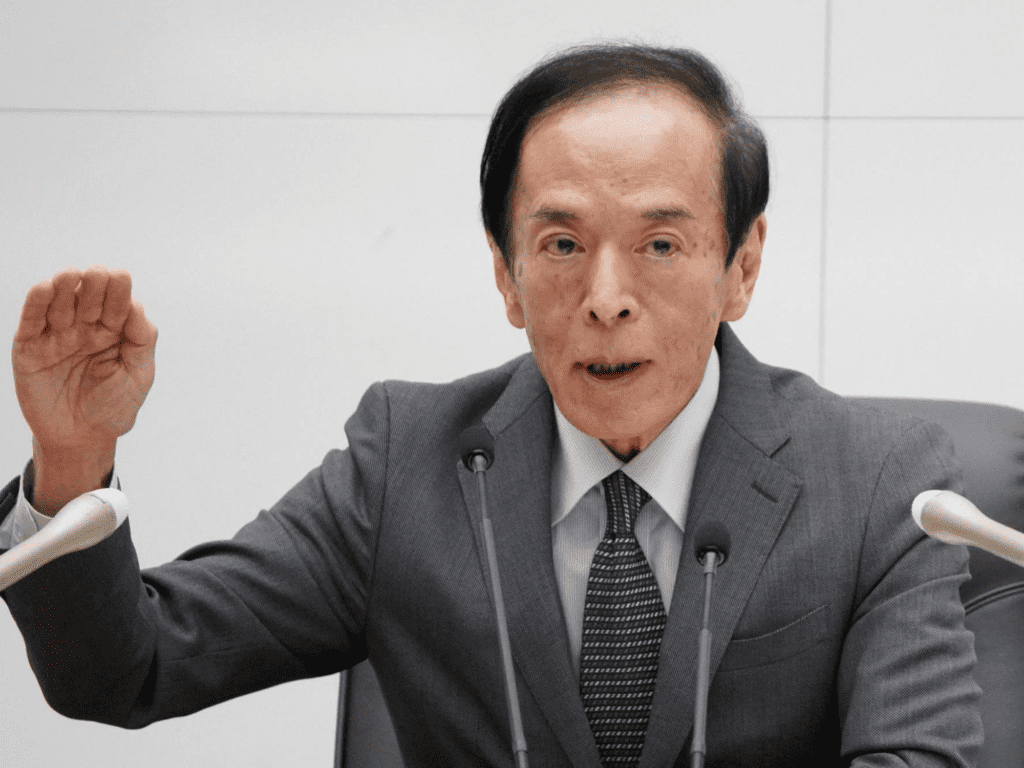

Currency Turmoil:

- The offshore yuan (CNH) breached critical support levels, tumbling to 7.32 /$ (weakest since Nov 2023)

- The People’s Bank of China (PBOC) set its official midpoint at 7.29, maintaining the widest gap with market rates

- South Korean won drops 1.8%, Australian dollar -1.2%

“Markets are pricing in a full-scale trade war,” said Nomura’s chief Asia economist Rob Subbaraman. “Currency traders interpret the yuan’s weakness as Beijing’s deliberate deployment of exchange rate policy to offset tariff impacts – a classic ‘currency weaponization’ playbook.”

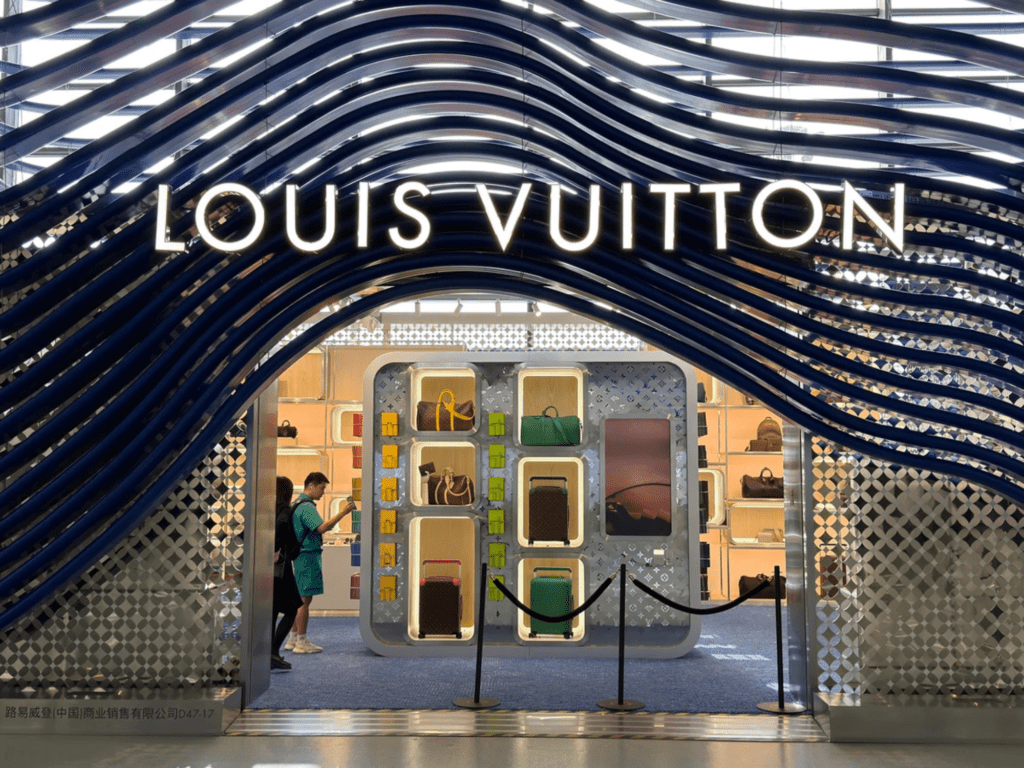

Sectoral Impacts:

- Tech: Semiconductor stocks (TSMC -3.9%) hit by supply chain fears

- Automotive: BMW’s China JV suspends expansion plans

- Commodities: Iron ore futures drop 6% on demand concerns

Morgan Stanley slashed its 2025 earnings outlook for Asian equities (ex-Japan) by 300 basis points to just 4%, as analysts cautioned that without clear U.S. trade policy signals, the regional selloff risks accelerating into a full-blown crisis.