Dollar Near 2½-Week Peak as Asian Stocks Waver Ahead of New U.S. Tariffs

U.S. Dollar Near 2-Week High as Trump’s Tariff Threats Shake Global Markets:

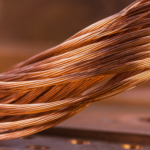

The U.S. dollar climbed toward a 2½-week high on Wednesday, bolstered by President Trump’s aggressive tariff threats, including a 50% levy on copper and looming tariffs on semiconductors and pharmaceuticals. U.S. copper futures soared to record highs overnight before paring gains, while Wall Street equities dipped modestly.

Across Asia-Pacific, equity performance remained mixed:

-

Japan’s Nikkei rose 0.3%

-

South Korea’s Kospi increased by 0.5%, as both capitals intensified trade efforts ahead of an August 1 tariff deadline

-

Mainland China’s CSI 300 edged up 0.3%

-

In contrast, Australia’s ASX 200 fell 0.5%, and Hong Kong’s Hang Seng declined 0.7%

Analysts remain cautious. Capital.com’s Kyle Rodda commented that the staggered tariff deadlines sometimes called “firm but negotiable” are being used as a negotiation lever, casting markets into temporary limbo.

Other asset movements:

-

Oil prices cooled slightly from recent highs

-

Gold prices fell further amid dollar and Treasury yield gains

Investors are keeping a close watch on how Trump’s shifting trade deadlines will unfold and whether the tightrope walk between diplomacy and economic pressure can stabilize markets.

U.S. Dollar Strengthens Amid Global Market Tensions:

In recent weeks, the U.S. dollar has exhibited incredible tenacity and gained ground against other major currencies. Investors are keeping a close eye on how trade policies, economic data, and geopolitical developments will affect its performance in the future. In times of uncertainty, the US dollar continues to be a favored safe-haven investment.

Trump Tariff: Impact on the U.S. Dollar:

The recent tariff announcements from Trump have been a major factor in the increase in the value of the US dollar. Investors responded swiftly when President Trump announced a 50% import tax on copper and alluded to additional tariffs on other industries. By raising demand for American assets, such policies frequently strengthen the dollar.

Global Market Reaction:

The signals from the global market have been conflicting. The U.S. dollar rose to multi-week highs while U.S. equity indexes saw a minor decline. While Australia’s ASX 200 and Hong Kong’s Hang Seng saw declines, Japan’s Nikkei and South Korea’s Kospi saw increases. The U.S. dollar’s strength has put pressure on some economies that rely heavily on exports.

Tariff Threats and Investor Sentiment:

Uncertainty is being caused by ongoing tariff threats. Global markets are in limbo as a result of these tariffs’ varying deadlines. As investors shift their money into safer currency holdings, the U.S dollar gains from this cautious attitude. Prolonged trade tension, however, might put the resilience of the US dollar’s rally to the test.

Safe-Haven Demand:

When investors look for stability, the US dollar does well. The demand for the US dollar as a safe haven has increased due to recent market volatility in commodities and stocks. Because of its liquidity and widespread trust, the dollar has maintained its appeal despite fluctuations in the price of gold and oil.

Economic Data and the U.S. Dollar:

In addition to trade policy, the U.S dollar is still supported by U.S. economic indicators. A strong base is provided by robust manufacturing data, stable GDP growth, and high employment rates. The momentum is maintained by each encouraging report, which keeps the US dollar at the top of investor strategies.

Short-Term Outlook for the U.S. Dollar:

If trade tensions continue, the U.S Dollar is anticipated to hold steady in the near future. A bullish outlook is created by the combination of Trump’s tariff policies, demand for safe haven assets, and strong economic results. However, any significant change in the negotiations could lead to quick changes in the market.

Long-Term Considerations:

The U.S. dollar will require more than just tariff-induced strength in the long run. Global economic stability, balanced trade relations, and steady growth are essential. The U.S Dollar may continue to be dominant for many years if the country can effectively manage these factors.

Key Points to Remember:

- The U.S. Dollar gains strength during uncertainty.

- Trump tariff policies have boosted short-term performance.

- Global market reactions remain mixed.

- Tariff threats create both opportunity and risk.

- Safe-haven demand continues to support the US Dollar.

Final thoughts:

In conclusion, the US Dollar remains a pillar of strength in uncertain markets. With trade tensions and tariff moves shaping sentiment, the US Dollar could stay resilient if economic fundamentals continue to support its upward trend.