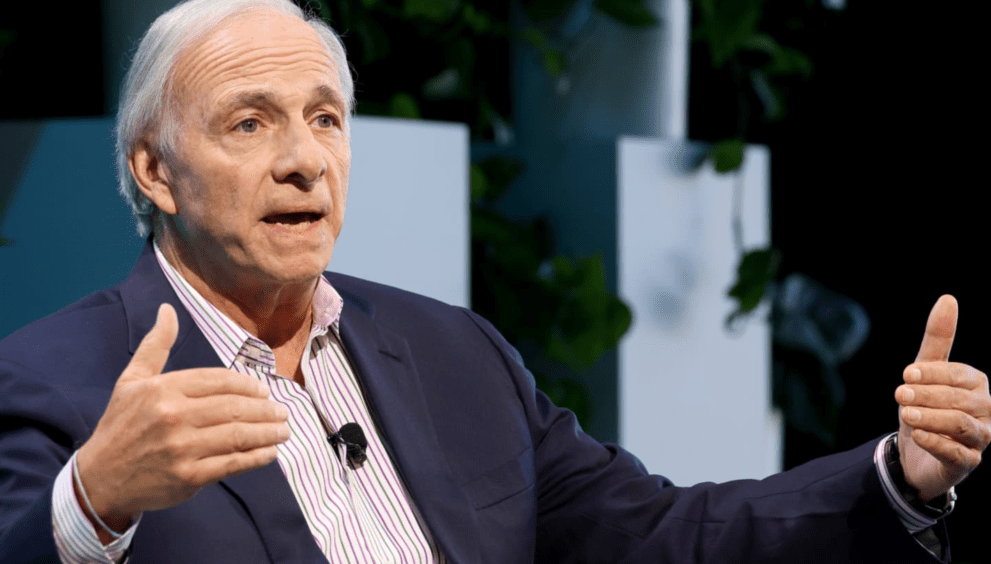

Ray Dalio Warns Today Mirrors Early 1970s, Urges Investors to Hold 15% Gold

Billionaire investor Ray Dalio told attendees at the Greenwich Economic Forum that current financial conditions resemble the early 1970s, and he urged investors to significantly increase holdings of gold as a buffer against inflation and monetary risks.

“It’s very much like the early ’70s,” Dalio said. “Where do you put your money in? When there is such a supply of debt instruments, they are poor stores of wealth.” He argued that traditional debt and fixed income positions are vulnerable in a high-debt environment.

As part of his advice, Dalio suggested a gold allocation of around 15% of one’s portfolio — a much more aggressive position than conventional frameworks typically allow. In his view, gold remains one of the few assets that can hold value when inflation and monetary erosion strike.

Prices for gold have already surged in 2025, at one point topping $4,000/oz, as investors seek safe havens amid fiscal uncertainty, rising deficits, and a weakening U.S. dollar.

However, critics caution that gold does not offer yield or cash flow, and argue allocations should remain modest, perhaps in the 2–5% range, rather than such high exposure.

Still, Dalio’s call underscores how many investors are reconsidering their allocations in an era of mounting debt, persistent inflation, and macro uncertainty. If today truly mirrors the early 1970s, gold’s role as a portfolio ballast may become more prominent.